child tax credit december 2021 amount

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Web The enhanced child tax credit was valid through the end of December 2021 which means that the limits and amounts will revert to the 2020 tax credit rules.

New Expanded Monthly Child Tax Credit Maine Immigrants Rights Coalition

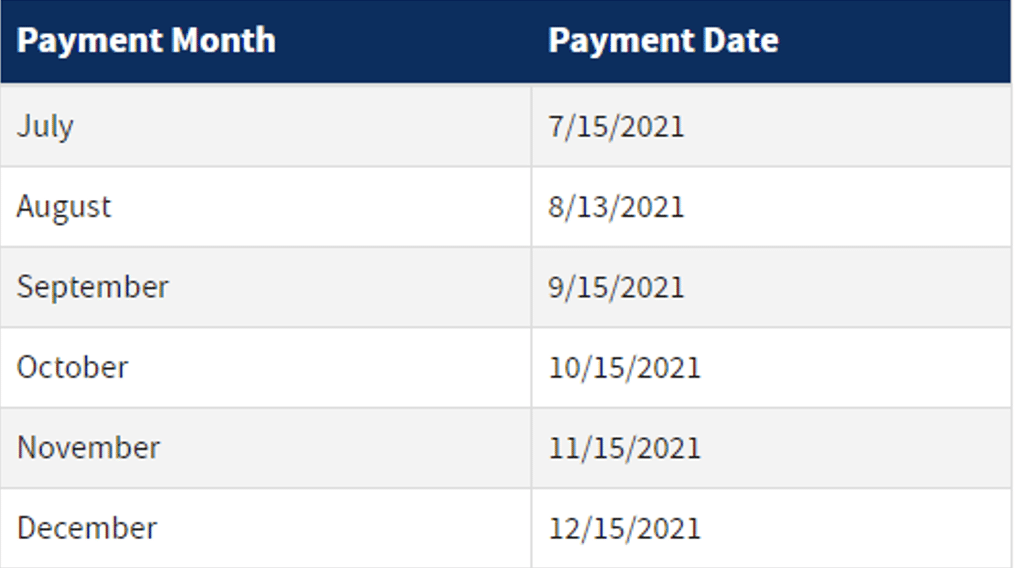

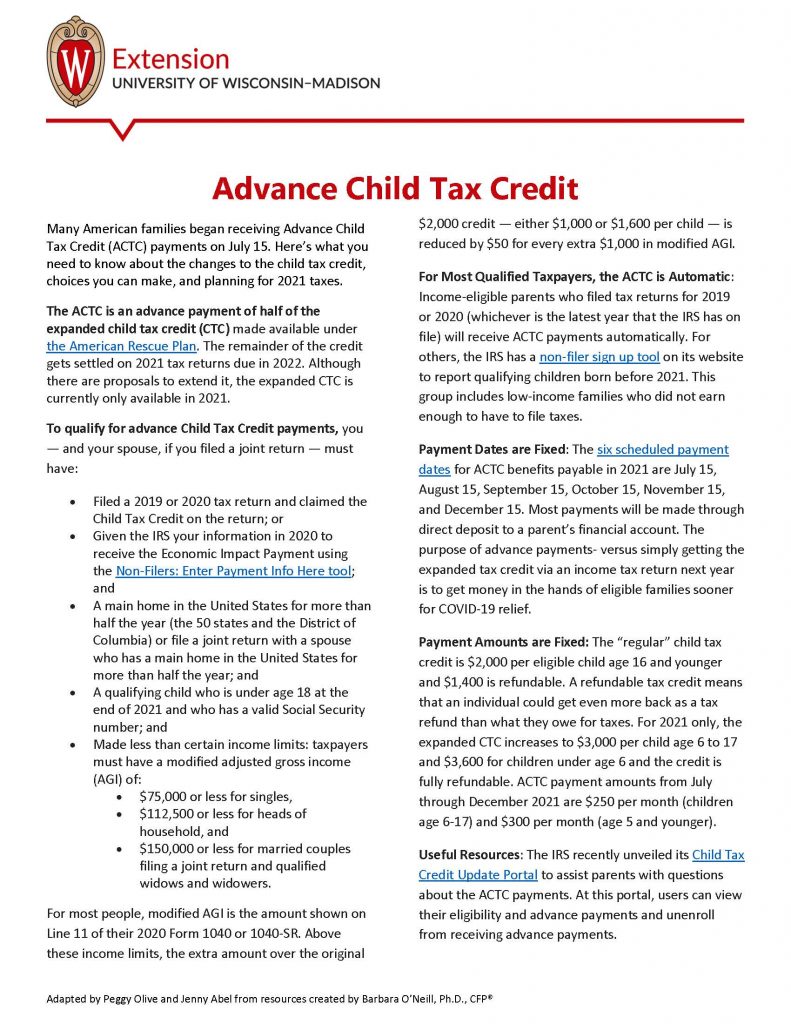

The IRS pre-paid half the total credit amount in monthly.

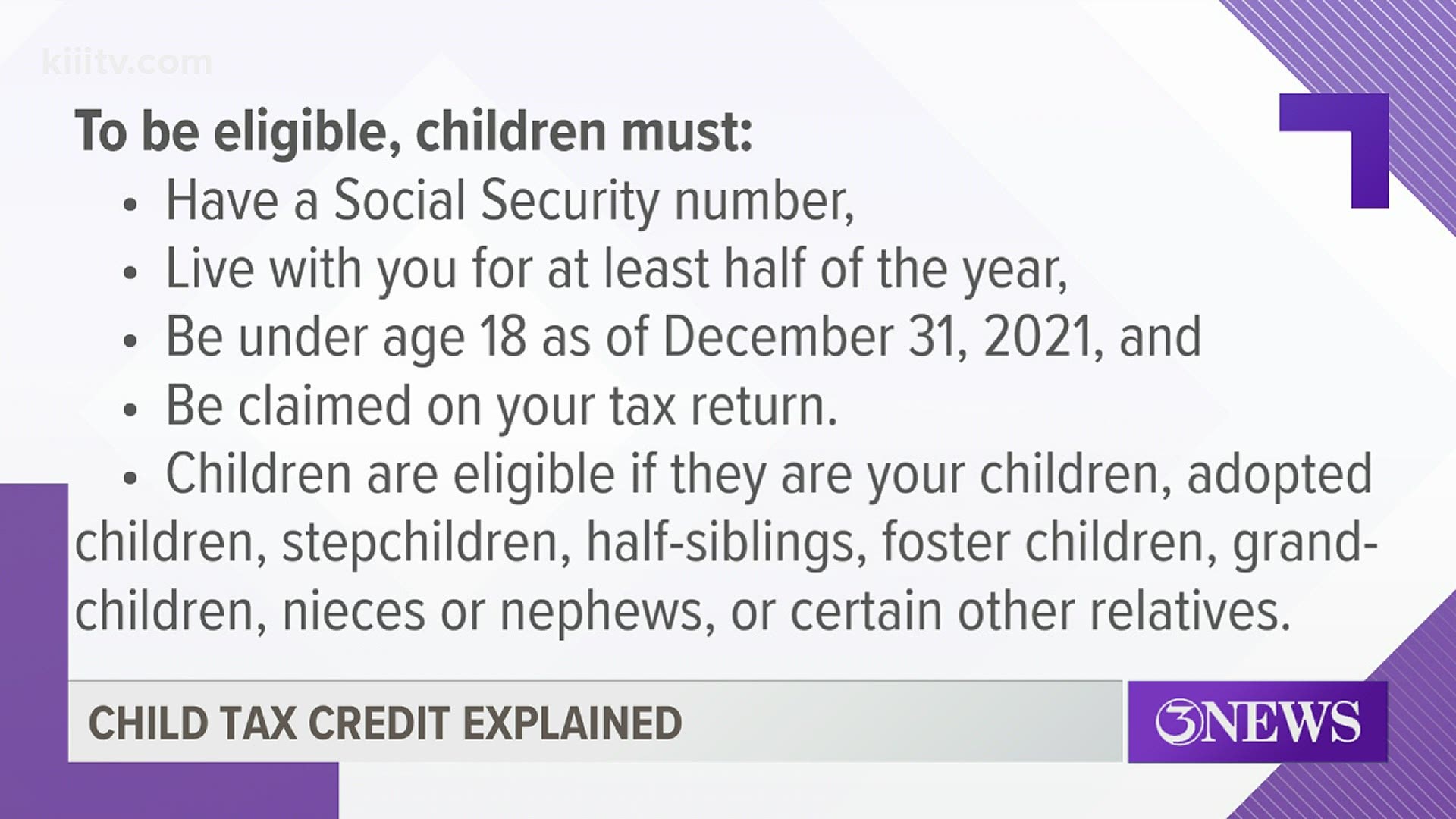

. Web A childs age determines the amount. The rebate amount is based. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit.

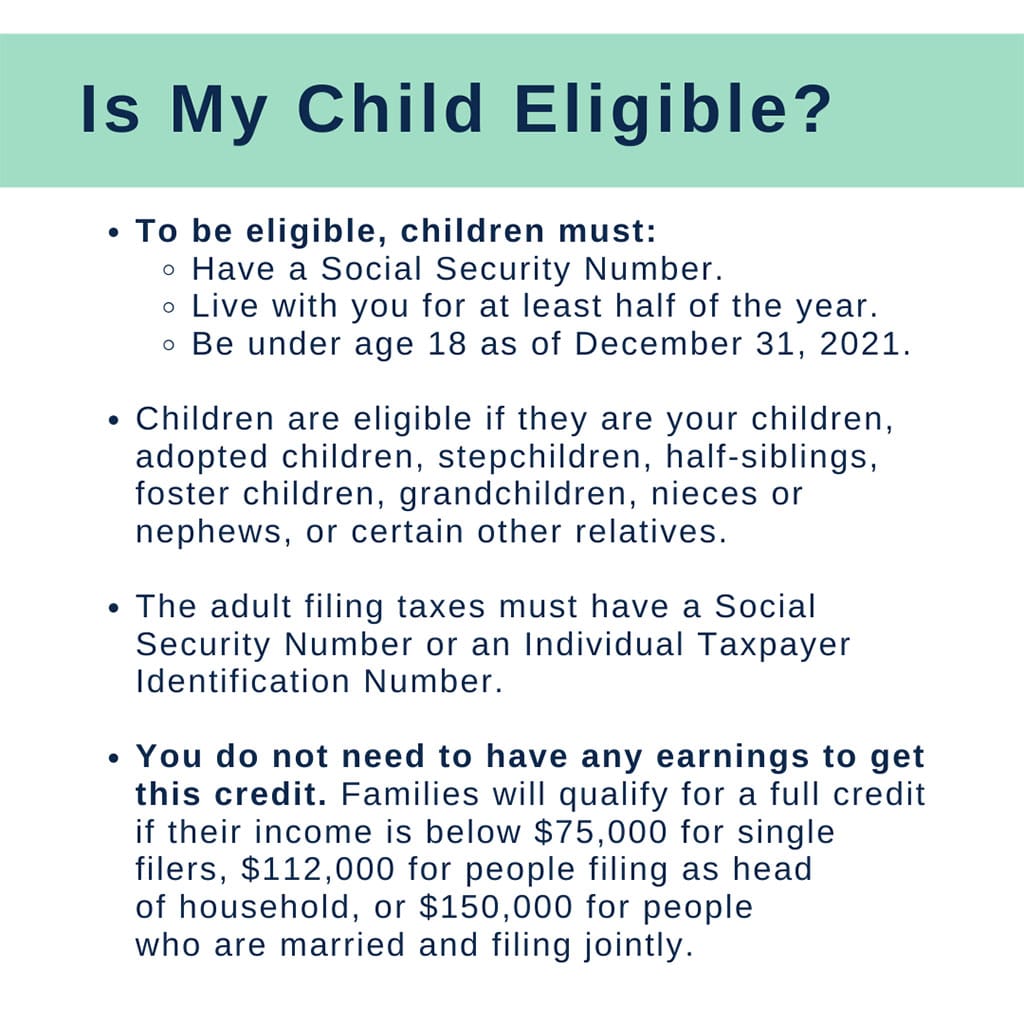

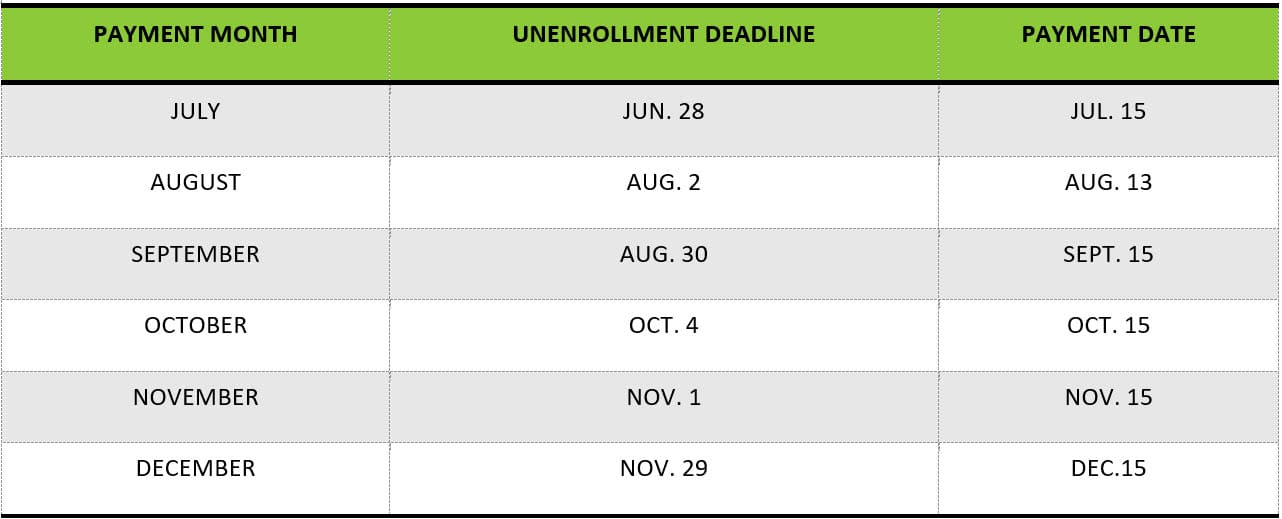

Web You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Previously only children 16 and younger qualified. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these.

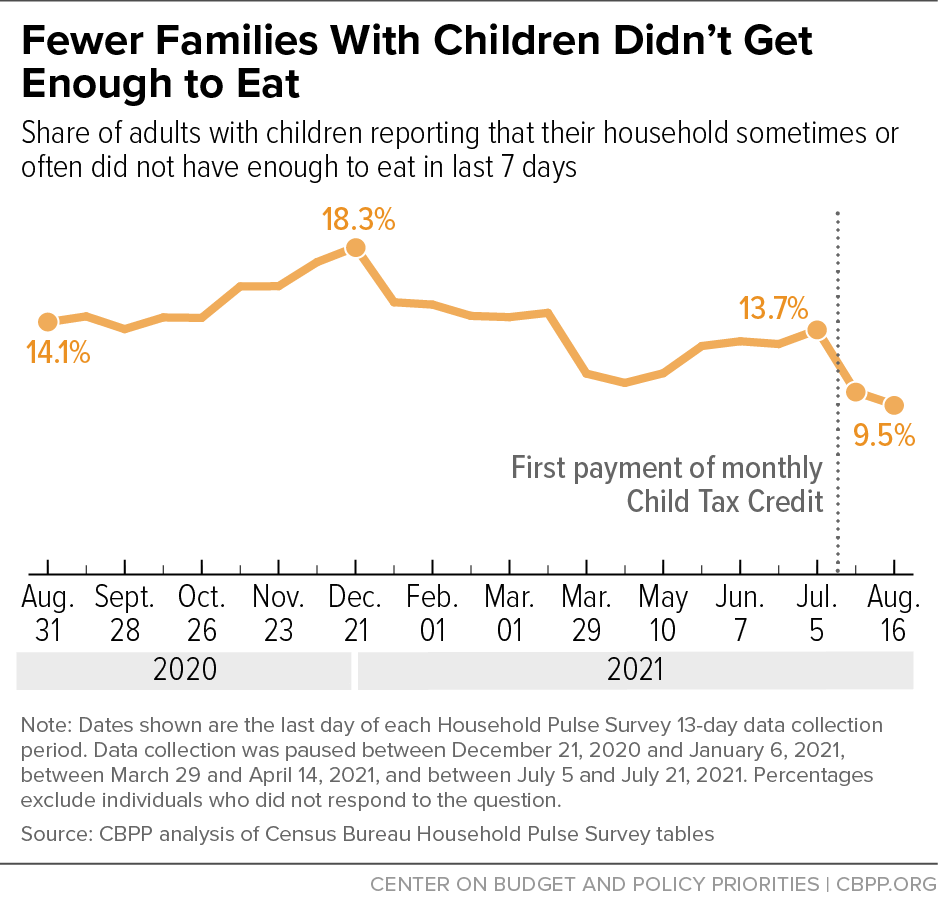

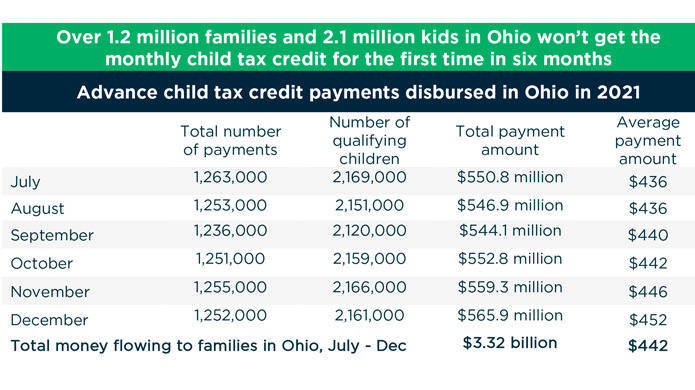

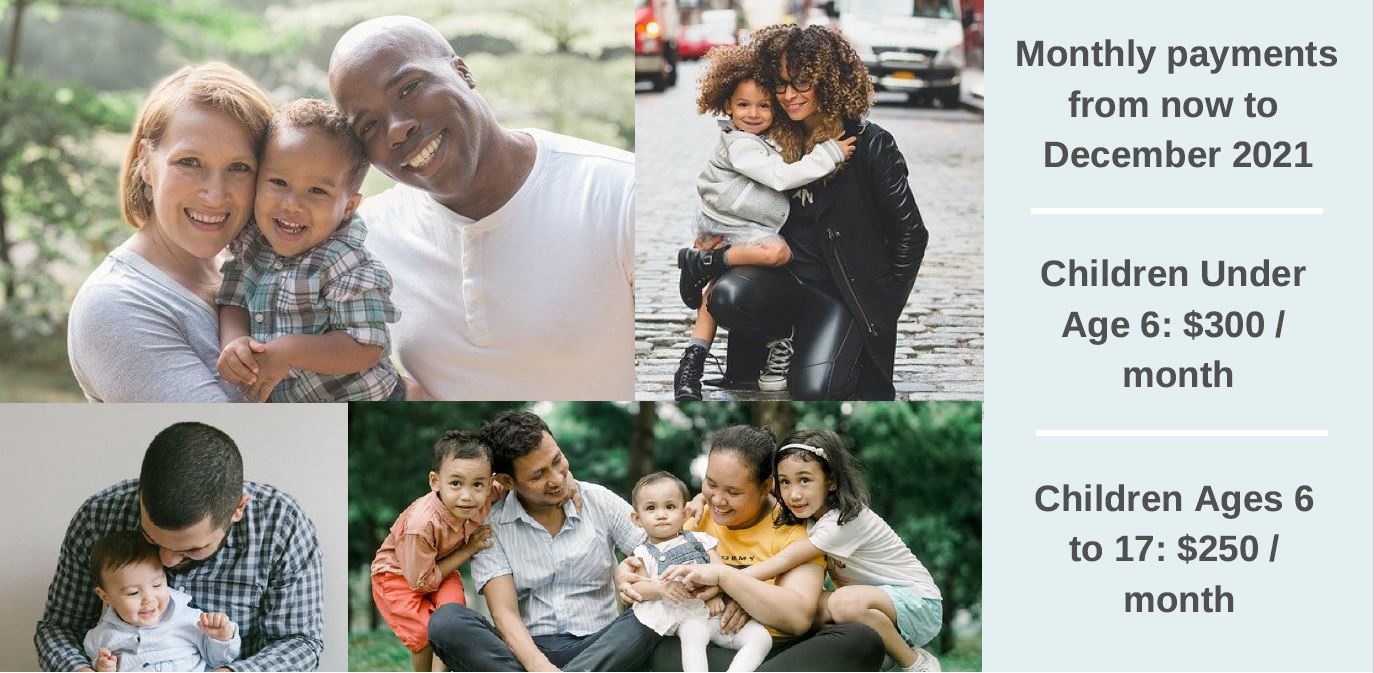

Web The South Carolina Department of Revenue SCDOR has begun issuing 2022 Individual Income Tax rebates to eligible taxpayers. Web The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. Web The Child Tax Credit was increased for 2021 from 2000 to 3000 per child and 3600 per child under the age of 6.

The credit amounts will. In addition the age limit was raised from. For 2021 eligible parents or.

Qualifying families can get up to 3600 per child under 6 years old. Web The Child Tax Credit has existed for over two decades and was significantly expanded in 2021. Families have a limited amount of time left to submit applications for the unclaimed stimulus funds.

Web The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. Web Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. Web The maximum child tax credit amount will decrease in 2022.

The American Rescue Plan significantly increased the. The amount changes to 3000 total for each child ages six through 17. Web 2 days agoDeadlines Approaching For Americans To Claim Child Tax Credits.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form. Web September 15. Web The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the.

Web That comes out to 300 per month through the end of 2021 and 1800 at tax time next year. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a. Web The credits scope has been expanded.

Child Tax Credit Who Will Get A Big December Check Wgn Tv

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

What To Know About The New Monthly Child Tax Credit Payments

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Child Tax Credit Deadline Update As Final 300 Payment Is Being Sent Out Tomorrow Here S How You Can Get Cash The Sun

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

Child Tax Credit Eligibility Kiiitv Com

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

It S Not Too Late To Claim The 2021 Child Tax Credit

Fact Sheet Advance Child Tax Credit

Advance Child Tax Credit Payments Hit Bank Accounts Ksnv

Wtform Child Tax Credit Letter 6419 Explained Youtube

Child Tax Credit Advanced Payments Information Bc T

Advance Child Tax Credit Financial Education

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

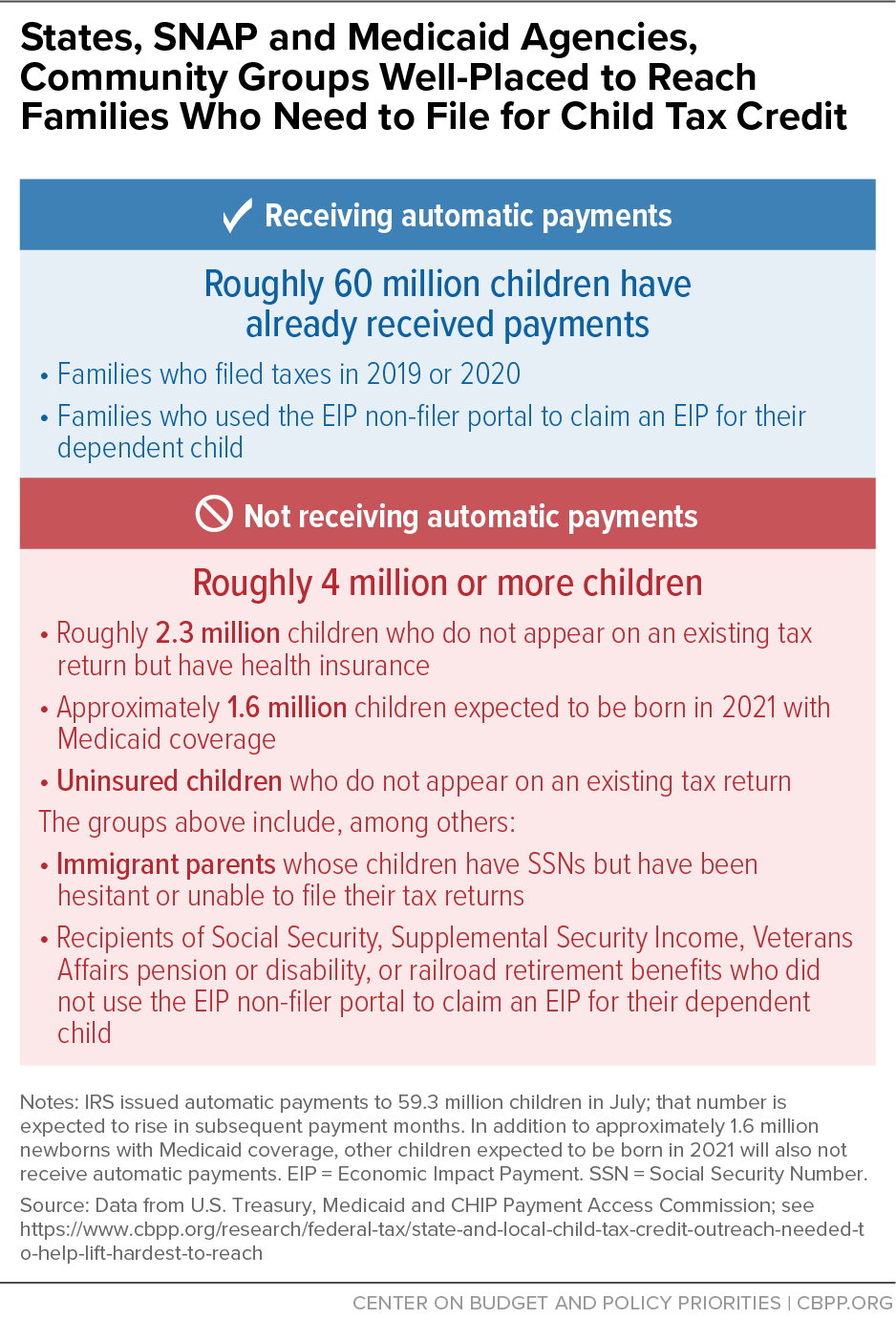

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities